Quarterly report | Q4 | Baltic States

Property

Snapshot

Q4 | 2022

Investment market

After a record breaking 2021, investment volumes both in Estonia and Latvia returned to a “normal” EUR 300 million yearly level. Investment activity in Estonia in 2022 (EUR 335 million in total) was largely driven by the industrial segment (36% of total volume) and several large lot-size deals (The top10 deals were responsible for a half of total volume). In Q4, total known investment volume exceeded EUR 74 million, driven by the closing of the Foorum BC deal by US Real Estate after receiving permission from the Competition Authority. During 2022, Infortar became the owner of Tähesaju Twins - 2 Stock Offices, of which one was acquired in March and the other in December from Restate, a developer. Yields remained unchanged by the end of the year, but higher interest rates put considerable upward pressure on yields (that will expand in 2023) and suppress investment activity, turning buyers to adopt a wait-and-expect-a-better-price attitude.

Key Investment Figures in the Baltic States, Q4 2022

Prime Yields

Estonia

Latvia

Lithuania

Office

5.5%

5.5%

5.25%

Retail

6.8%

7.0%

7.0%

Retail (grocery-led)

6.0%

6.5%

6.0%

Industrial

6.7%

6.5%

6.5%

Source: Colliers

Investment activity in Latvia in 2022 was largely led by Baltic investors and smaller (<5 mln EUR) transactions. In Q4, total investment volume reached EUR 95 million, seeing the largest deal of the year – the acquisition of Place Eleven (Class A office building in Skanste) for EUR 53 million by East Capital from Hanner, a developer. Blackstone finished divestment of its retail properties in Latvia and sold SC Mols to Citra Development. Other notable transactions included the acquisition of 2 warehouses in Marupe by Sportland for EUR 12.1 million (owner-occupation deal). In most European markets prime yields have already increased by 0.25-1.0 percentage points on average depending on the geography and segment, a trend already observed in Latvia with further inevitable yield corrections expected during 2023.

The end of the year was active in Lithuania with total investment volume exceeding EUR 170 million in Q4 2022. The retail sector accounted for most (around 70%) of total quarterly volume, mainly driven by divestment (share deal) to NDX Group of a portfolio of 17 Maxima and Ermitazas stores in Lithuania with total GLA 45,000 sqm from the Norwegian investment company EECP (the largest transaction since 2019). Another large lot-size transaction included the acquisition of a land plot with a building permit for construction of a business centre at Ukmergės Str. in Vilnius to Diff Finance, an investment company. Meanwhile, investments in other segments remained subdued. Compared to the previous quarter, prime yields remained stable with the potential to expand in the coming year.

Office market

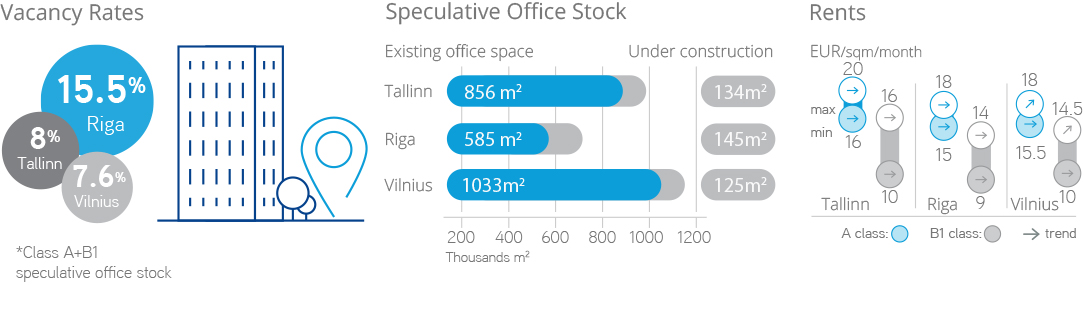

Development in the Tallinn office market remains constantly active with total GLA exceeding 134,000 sqm (11% of total stock; 12 projects) under construction in January 2023. Q4 2022 saw completion of 7 new office buildings with total GLA 47,250 sqm (incl. the Alma Tominga building in Ülemiste City, Tehnopol3kv in Tehnopol Park, Kawe City and P21 both in CBD and the new G4S HQ in Kristiine) and the start of construction work on a new large-scale BtS redevelopment project in Põhja-Tallinn. Despite rather calm demand, the market observed several significant pre-leases, driven by relocations and expansions in the ICT sector. Vacancy continues to fluctuate around 8%, seeing some upward movement in Class B1 buildings. Additionally, some not really positive news from the programming, blockchain and call centre segments in Estonia (staff reductions, freezing of relocation plans) result in growing hidden vacancy that may further reshape to physical vacancy in the first half of 2023.

Key Office Figures in the Baltic States, Q4 2022

Class

Tallinn

Riga

Vilnius

A Class Rents

16-20

15-18

15.5-18

B1 Class Rents

9.9-16

9-14

10-14.5

A Vacancy*, %

5-6%

19-20%

7-7.5%

B1 Vacancy*, %

8-9%

9-10%

7.5-8%

Source: Colliers . EUR/sqm/month; *-speculative office market vacancy rate

Q4 2022 has been relatively quiet in terms of office activity in Riga. The office pipeline remains filled with around 145,000 sqm of office GLA under construction. With new developments moving closer to commissioning, competition for anchor tenants remains strong. Rising additional costs in older buildings, remote work and decreasing office space per employee ratio allow tenants to relocate to smaller but better-located and higher-quality premises within the same budget. Even though many lease agreements in theory are subject to high indexation figures, landlords in older developments are forced to cap indexation to remain competitive. Meanwhile, rent rates for new agreements in existing developments are becoming highly dependent on required fit-out contributions. The past 2 years of silent planning in the co-working segment finally resulted in activity - Workland announced plans to open a co-working space in Verde, Regus plans to launch a new facility in the Business Garden complex, while a free-of-charge co-working space opened in Spice SC.

Office Trends

Source Colliers

In Vilnius, Q4 2022 was not active in terms of commissioning new office space. Just one building with GLA 8,000 sqm was put into operation at Savanoriu Ave. 28 in Vilnius. The pipeline for 2023 new office space remains at 116 thousand sqm. Nevertheless, Q4 was comparatively active in terms of new leases, including quite big ones: Visma, Modus Mobility, GetJet Airlines and others. New business centres planned for commissioning in CBD in 2023 showed sustainable demand: Artery, Flow. Rent rates remained stable with upward pressure on Class A premises (up to 18 EUR per sqm). Total vacancy decreased to 7.7%, while vacancy in Class A buildings remained stable at 7.3%.

Retail market

In Q4 2022, inflation stood at the centre of attention both for landlords and retail tenants in all three Baltic States. In Latvia, first indications show that landlords will apply a full indexation approach. However, similarly as was the case with rent discounts during the pandemic, they are ready to discuss other options for some tenants individually. In Estonia, landlords admit choosing various approaches depending on retailers, turnover figures and other factors, while the range may vary from 3-10% up to full indexation.

In Estonia, the retail development market continues to remain active mainly outside Tallinn city borders, seeing the opening of the multifunctional Tabasalu Centre (8,000 sqm; tenants - Selver, 24-7 fitness and other primary level services for residents of the local community) next to Tallinn city borders. Tallinn shopping centres continue diversification of their tenant mix - Viru Keskus officially celebrated the opening of the Ilusfäär beauty and healthcare cluster and introduced new fashion stores (incl. Marciano by Guess, Jo Malone London Boutique, Pinko, Karl Lagerfeld, etc). T1 Centre opened a new entrance facing the rail line and opened four new outlets (Rademar, Denim Dream, Sportland, Hot Lips) with total GLA exceeding 3,600 sqm in the centre, positively affecting the total vacancy level in Tallinn. As already expected, various outlets and discount chains that offer apparel and household goods at the lowest prices continued gaining a major share of take-up in all types of shopping centres across Estonia.

Retail Trends

Source Colliers

In Latvia, following a lengthy refurbishment period, former Prisma Deglava reopened as a new retail concept named “Augusts” with Lemon Gym, Sinsay and a farmers’ market as the main attractions. Medical offer continued to expand within retail premises - a 1,000 sqm VCA health clinic opened in SC Dole. Can Can pizza and Caif Café plan to exit the market by the end of January 2023, closing a total of 10 locations in Latvia after a challenging post-pandemic period. At the same time, Domino’s Pizza entered the market, opening their first location in Riga. The coffee shop segment saw a new market entry by domestic bar/restaurant chain Ezītis Miglā which opened its first Ezīša Kofīšops in Riga city centre.

In Q4 2022, retail stock remained unchanged in Vilnius, but the market is showing additional interest in the concept of retail parks with the Una retail park (GBA 16,640 sqm) currently under construction and a retail park (GBA 6,500 sqm) planned nearby at Dangerucio St 2. Miniso, a popular Asian low-cost retailer offering home, beauty and leisure products and toys, opened its first store in Lithuania in CUP SC. Some international discounter chains such as Pepco, Sinsay, and Lidl have lately achieved rapid expansion in the market. However, due to the war and the uncertainty surrounding it, plans for the entry of new brands are temporarily suspended. So, if the situation in the region does not worsen in 2023, Lithuania and the other Baltic States are expected to see the emergence of new brands. That said, rents in prime SCs have been rising, while vacancy remains low and stable.

Key Retail Figures in the Baltic States, Q4 2022

Tallinn

Riga

Vilnius

Prime SC Rents*

23-45

23-40

25-50

Prime High Street Rents*

25-38

15-30

25-42.5

Vacancy in SC

3.4%

7.3%

2.3%

Source: Colliers . *EUR/sqm/month; SC – shopping centre

Industrial market

The industrial segment remains active in Tallinn and its suburbs in terms of new developments with a total area of approx. 121,000 sqm (22 projects) under construction in January 2023. Although Q4 2022 saw easing of growth and even some decline in construction prices, the number and volume of new projects started during the quarter continued to ease and most “under construction” volume is generated by several large-scale BtS projects (Makita LC, EFG Farmacy Factory, Repligen production). Bigger players still prefer the built-to-own approach, although lack of available large vacant land plots forces them to look more for existing buildings and/or renew their lease agreement in their current locations at higher rents. 18 new Stock Offices with total GLA 63,350 sqm were added to the market during 2022, while ca 44,200 sqm (9 projects) remain under construction. Despite recent threats and challenges in the segment, the overall vacancy rate remains low at 2.7%.

Key Industrial Figures in the Baltic States, Q4 2022

Tallinn

Riga

Vilnius

Prime Rents*

5.0-6.6

4.2-5.2

4.6-5.5

Vacancy

2.7%

0.8%

0.4%

Source: Colliers . *EUR/sqm/month

In Latvia, Green Park III (1st building) developed by Piche was put into operation in the Airport area, adding 7,064 sqm of industrial space in Q4 2022. Additionally, Q4 saw completion of the year’s third stock office project - Kengaraga Centrs with GLA 4,423 sqm. Some developments that were planned for commissioning by the end of 2022 have been postponed to the first half of 2023. Currently, 128,370 sqm of leasable industrial space remains under construction. Demand for industrial and warehouse premises remains stable with total take-up exceeding GLA 90,000 sqm in 2022. Vacancy in the market remains low at 0.8% due to a lack of new speculative projects put into operation, while those approaching completion are fully leased. Due to lack of options in the market, the upper rent rate threshold for new developments is expected to increase.

In Q4 2022, total warehouse stock in Vilnius region remained stable. However, the development pipeline was active with under construction volume increasing by 35% to a total GBA of 148,500 sqm at the end of the quarter, of which almost 50% consists of speculative projects, including construction of the J55 LC (1st stage, GBA 31,600 sqm) started by Sirin. Demand remained modest as some expansion plans were cancelled or suspended due to various uncertainties, as well as an increase in rent rates by more than 10%. In Q4, gross take-up reached almost 20,000 sqm, accounting for 23.5% of total annual volume. Leasing activity was driven by the renegotiation of expired leases as well as pre-leases, mainly from wholesale, retail, and logistics companies. Despite a challenging year, vacancy remained at an all-time low level throughout the year, decreasing to 0.4% by year-end. However, with an active construction pipeline and slightly shrinking demand, the market is expected to see an organic increase in vacancy in 2023.

Industrial Trends

Source Colliers

Trends for 2023

- 2023 is expected to see a slowdown in investment activity, especially in the first half of the year as buyers continue to adopt a rather wait-and-expect-a-better-price attitude.

- The investment market is expected to be led by local players and a higher proportion of smaller lot-size transactions, which in turn will impact total investment volumes achieved in the Baltics.

- Overall, total investment volume in the Baltics is expected to remain below the traditional EUR 1 billion threshold in 2023 with the majority of transactions expected in the second half of the year.

- Higher interest rates put considerable upward pressure on yields, which will clearly expand in the first half of 2023.

- Cross-border cooperation might become more noticeable: investors as well as some other market players from the Baltics are looking for opportunities in Poland and other (CEE) countries, while several foreign retail chains and brands consider the Baltics as an opportunity.

- Lower quality office space will underperform in 2023.

- Refurbishment of existing office buildings is expected to become increasingly popular.

- Remote work enables companies to accommodate a larger number of employees within the same office, allowing companies to relocate to better located, higher quality and energy efficiency premises, keeping total costs at the same level.

- Demand for offices in Vilnius is expected to remain at a comparatively high level.

- Interest in ESG, green and energy efficient technology will be more evident in 2023.

- Inflation, as well as increased cost of debt, is a concern for retailers in terms of consumer spending, which has been on the decline as disposable incomes shrink.

- The retail segment will see increased rotation of tenants in shopping centres.

- After the end of the pandemic, street retail tenants used the opportunity to fill vacancies and relocate to shopping centres, which will continue to negatively affect the vacancy rate in the street retail segment.

- Hidden vacancy may start to reshape as physical vacancy, while the number of debtors in all RE segments will grow.

Contact

Maksim Golovko

Research & Forecasting | Estonia

Colliers International Advisors

Estonia Office

+372 6160 777

Toms Andersons

Research & Forecasting | Latvia

Colliers International Advisors

Latvia Office

+371 67783333

Denis Chetverikov

Research & Forecasting | Lithuania

denis.chetverikov@colliers.com

Colliers International Advisors

Lithuania Office

+370 5 2491212

colliers.lithuania@colliers.com

© 2022 :: Colliers International